Wellness Wisdom: Expert Financial Strategies for a Healthier Future

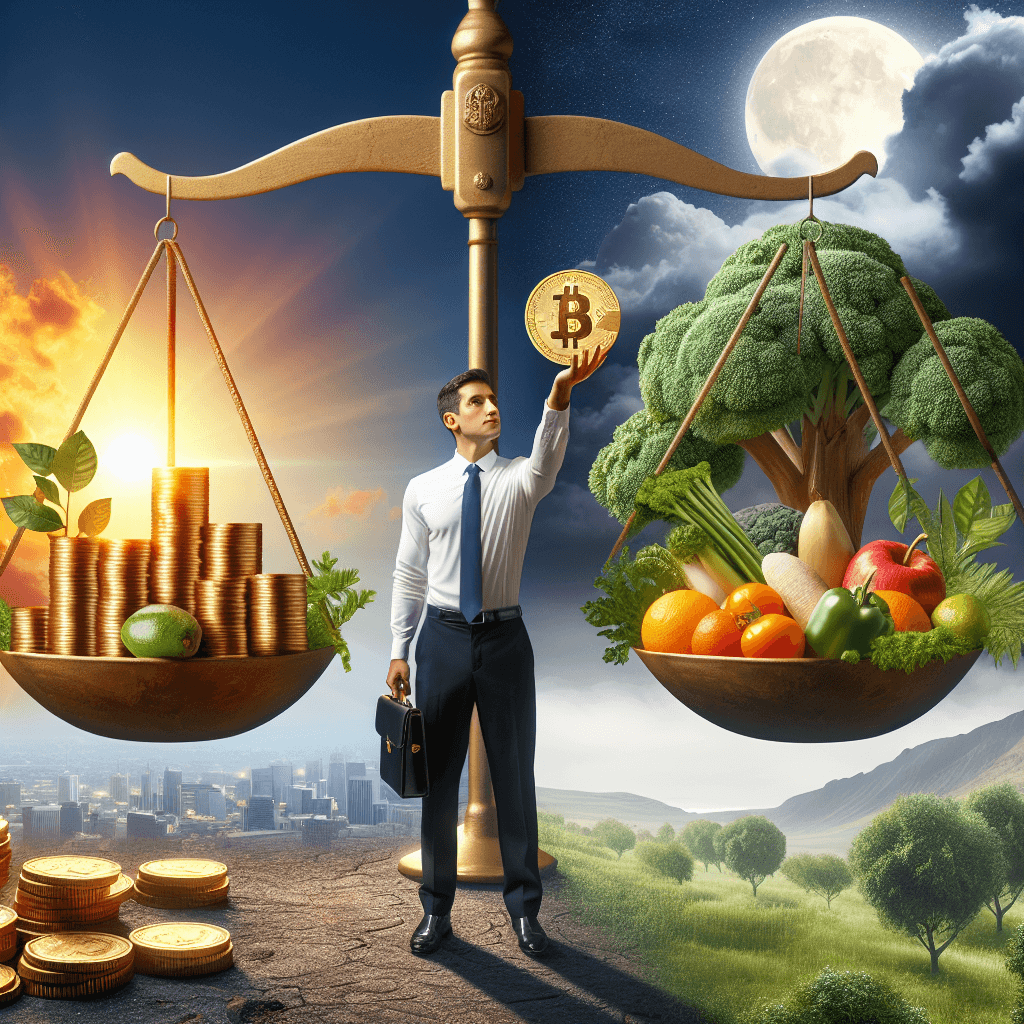

Wellness, in its truest sense, extends far beyond the realm of physical health. It encompasses a holistic sense of well-being that incorporates our mental, emotional, and yes, even financial health. While we often prioritize diet and exercise, the reality is that financial stress can be a major detriment to our overall wellness. Chronic worry about money can lead to sleeplessness, anxiety, and even depression, creating a vicious cycle that impacts every aspect of our lives. The good news is that achieving financial wellness is within reach for everyone. It's about making conscious choices today to secure a healthier and more prosperous tomorrow.

Understanding the Connection: Financial Health and Overall Well-being

The link between our wallets and our well-being is undeniable. When we feel financially secure, we experience greater peace of mind, knowing that we can weather unexpected storms and pursue our goals with confidence. This sense of security ripples outward, positively impacting our relationships, career aspirations, and overall outlook on life.

Conversely, financial instability can cast a long shadow. It can lead to feelings of shame, helplessness, and fear, hindering our ability to make sound decisions and enjoy life to the fullest. This is why it's crucial to view financial wellness not as a luxury, but as an essential component of a healthy and fulfilling life.

Building a Foundation: Essential Financial Strategies for a Brighter Future

Just as we adopt healthy habits for our physical well-being, we can cultivate positive financial habits to bolster our financial health. Here are some key strategies to get you started:

1. Create a Realistic Budget (and Stick to It!)

Budgeting often evokes feelings of restriction, but in reality, it's about empowerment. A well-crafted budget gives you a clear picture of your income, expenses, and spending habits. It allows you to track where your money is going and identify areas where you can save. Remember, a budget isn't about deprivation; it's about aligning your spending with your values and goals.

Practical Tips:

- Utilize Budgeting Apps: Leverage technology to simplify the process. Numerous apps are available to help you track expenses, set financial goals, and stay accountable.

- The 50/30/20 Rule: Consider this popular budgeting method: allocate 50% of your income to needs (housing, food, transportation), 30% to wants (entertainment, dining out), and 20% to savings and debt repayment.

- Regular Review and Adjustment: Your financial situation is dynamic, so it's important to review and adjust your budget regularly to reflect changes in income, expenses, or goals.

2. Prioritize Saving: Building a Safety Net and Achieving Financial Goals

Saving is the cornerstone of financial security. A healthy savings account provides a cushion for unexpected expenses, allowing you to navigate financial emergencies without derailing your long-term goals.

Practical Tips:

- Automate Your Savings: Set up automatic transfers from your checking account to your savings account each month. This "pay yourself first" approach ensures consistent saving.

- Emergency Fund: Aim to build an emergency fund covering 3-6 months of living expenses. This fund acts as a safety net in case of job loss, medical emergencies, or other unexpected events.

- Goal-Oriented Saving: Break down larger financial goals (down payment on a home, education, travel) into smaller, manageable savings targets. This makes the goal less daunting and more achievable.

3. Manage Debt Strategically: Reduce Financial Stress and Regain Control

Debt can be a major source of financial stress, but it's important to remember that not all debt is created equal. Managing debt effectively involves understanding the different types of debt and developing a strategic plan for repayment.

Practical Tips:

- High-Interest Debt First: Prioritize paying down high-interest debt (credit cards) as quickly as possible. Consider debt consolidation or balance transfer options to lower interest rates.

- Negotiate with Lenders: Don't be afraid to contact your lenders to discuss lower interest rates or payment plans. They may be willing to work with you, especially if you're experiencing financial hardship.

- Seek Professional Guidance: If you're struggling with debt, consider seeking guidance from a certified financial advisor. They can help you create a personalized debt management plan.

4. Invest in Your Future: Grow Your Wealth and Secure Long-Term Financial Wellness

Investing may seem intimidating, but it's an essential component of building long-term wealth and achieving financial freedom. The key is to start early, stay informed, and invest wisely.

Practical Tips:

- Start Small, Start Early: Even small contributions to investment accounts can grow significantly over time thanks to the power of compound interest.

- Diversify Your Portfolio: Don't put all your eggs in one basket. Diversifying your investments across different asset classes (stocks, bonds, real estate) can help mitigate risk.

- Seek Professional Advice: Consider consulting with a financial advisor to determine the best investment strategies based on your risk tolerance, financial goals, and time horizon.

Financial Wellness: A Journey, Not a Destination

Remember, achieving financial wellness is not a one-time event but an ongoing journey. It requires consistent effort, informed decision-making, and a willingness to adapt to changing circumstances. Embrace the process, celebrate your progress, and don't hesitate to seek support when needed.

Ready to Take Control of Your Financial Future?

Explore a wealth of courses and resources on 01TEK, designed to empower you with the knowledge and skills to make informed financial decisions and achieve lasting financial well-being. Your journey to a healthier, more prosperous future starts today.

We can do anything we want to do if we stick to it long enough.

Helen Keller